Good Morning,

Stocks fell on Friday, led by major tech shares, as Wall Street wrapped up a difficult week in which coronavirus cases rose, U.S. fiscal stimulus talks broke down and traders braced for next week’s presidential election.

The Dow and S&P 500 fell 6.5% and 5.6%, respectively, and posted their biggest weekly losses since March. The Nasdaq lost more than 5% over that time period and also had its worst one-week performance since March.

Those weekly losses came as the seven-day average of new coronavirus cases in the U.S. hit an all-time high this week, according to data from Johns Hopkins University. In Europe, Germany, France and the UK announced new lockdown measures to curb the virus’ spread.

Our Take

Massive policy stimulus, positive medical developments, a belief that lockdowns were discredited and high hopes for a return to pre-pandemic economic activity levels have provided solid support for equity markets yet with each passing day, they each seem to be on increasingly shaky ground. Stimulus is now likely stalled until the new year, new economic restrictions in the form of lockdowns, particularly in Europe, in response to the re-acceleration in COVID-19 infections, are now catching investors attention triggering a re-evaluation of downside risk.

Investors had been betting on both sides reaching a stimulus deal before Tuesday’s vote and now recent data is suggesting that the recovery may continue to lose momentum without new aid just as governments face pressure to re-lockdown.

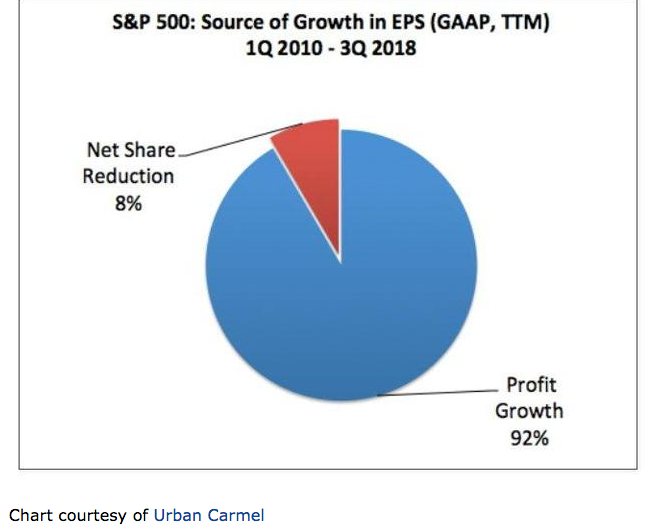

On a more positive note, we are now halfway through a spectacular third-quarter earnings season. So far, 85% of companies have beat expectations by an astounding 19% on average, well above the historic average of 3% to 5%, according to The Earnings Scout.

But the market has shrugged. The S&P 500 is 8% below where it started on the day earnings season began Oct. 13.

Why? It’s simple: markets don’t live on past earnings reports, however good they may be. They live on future earnings projections, and they are now in danger of plummeting. Markets are being hit with a quadruple whammy: The reopening narrative is in trouble, with politicians opting for fresh lockdowns despite clear evidence of their disastrous economic effects; stocks are richly priced, even for an economic recovery; strong earnings reports are not moving stocks up; and some CEOs are again, declining to provide guidance, leaving analysts to themselves.

The reopening story is in jeopardy. Investors were betting that the reopening would continue to proceed without lockdowns, and that additional stimulus would be coming to bridge the gap to a vaccine that would be widely available sometime in the second quarter. In other words, investors priced in rational political leadership that was data driven and awake to the long term economic and social health of their nations.

Then Europe happened. Germany, France and the UK decided to re-lockdown, closing bars and restaurants for at least a month. More lockdowns, more of the same failed policies, instead of learning from our failures and the successes of other eastern nations. The strategies pursued by South Korea, Vietnam, China and others do still seem to be paying off. While the total Covid-19 death toll is between 500-700 per million people in France, the U.K., Spain and the U.S., in China and South Korea it is below 10 per million.

If the key to avoiding more lockdowns is finding a way to “live with the virus” — through widespread testing, investment in health infrastructure, protecting the vulnerable, tracing of contacts and isolating positive cases to slow transmission — Western countries have made structural, not cultural, errors.

The problem is that even if outright lockdowns do not happen in the U.S., a widespread slowdown in economic activity — with many simply refusing to go out regardless of whether stores and restaurants are open or not — is increasingly likely given the following reality:

Third-quarter numbers have been great, but Wall Street had been betting that the following three quarters (Q4, Q1, and Q2) will also see sequential improvement as the reopening story proceeds. The lockdown story likely kills all of this and companies know it as many have declined to provide guidance to analysts.

The prospects of renewed economic slowing, if not the outright onset of a new recessionary phase in 2020 Q4 and 2021 Q1, due to lockdowns would also likely result in meaningful downward revisions to corporate earnings forecasts that were until recently getting revised marginally higher but remain depressed below pre-COVID levels.

If politicians choose to go down this road, U.S. stocks are likely set up for meaningful disappointment as these earnings forecasts increasingly fall apart. Will investors want to own stocks at 60 times or 80 times earnings, if not more?

Put this ugly package together, and you have a high degree of macro uncertainty, with stimulus doubts, lockdown threats, uncertainty on the timing of the vaccine, and the election.

It’s a potentially explosive combination that on its face, appears to be a nightmare for investors. On top of such worries you have hedge fund gurus lining up to call a top as well as calling for “a lost decade” for stocks.

So what to do in the face of the above?

Musings

We do believe that the current climate does represent accumulating potential downside risk, yet we prefer to remain cautiously optimistic and focus on “what is” rather than “what if”.

Leadership in the west is abysmal yet we are not surprised. Leadership is simply a reflection of those who elect such leaders and studies show that people in the West are getting “dumber” by the year.

A recent study found that 19 percent of young New Yorkers — millennials and Gen Z — believe Jews caused the Holocaust. A shocking 58 percent of New York state adults between 18 and 39 could not cite the name of any concentration camp, death camp or ghetto.

A survey in 2013 by the Public Religion Research Institute found that 27 percent of Americans think God helps determine the outcome of football games. A 2012 survey by the National Science Foundation found that 26 percent of Americans believe the sun goes around the Earth instead of the other way around, which indicates people haven’t been keeping up with the newspapers since about 1532. As for Democrats, 67 percent of them said (in a 2018 YouGov poll) that Russia “tampered with vote tallies in order to get Donald Trump elected.” There is no more evidence for this than there is for the existence of vampires. A survey last year found that the majority of residents in every state except Vermont would have failed a citizenship test.

In another recent study it was found that the IQ scores of young men have plunged below previous generations for the first time in nearly a century. For the past 90 years, the IQ levels of young people were believed to have steadily increased by about three points per generation in a phenomenon dubbed the Flynn effect. But the selfie generation’s empty-headedness may be linked to the way math and language are now taught — along with more time spent on TV and cell phones/computers researchers said. This is the most convincing evidence yet of a reversal of the Flynn effect.

Given the above, should we really be surprised by the intellectually vacuous debates we’ve witnessed in the run up to November 4? Should it shock us that politicians aren't learning and improving their responses to the pandemic?

We are facing nothing short of an intelligence crisis in the West from the bottom right up to the top, which is undermining our problem-solving capacities and leaving us ill-equipped to tackle the complex challenges posed by pandemics, AI, global warming and developments we have yet to imagine.

Investors should be aware of these shortcomings (think of it as a cognitive decline risk or ignorance risk) and take them into consideration as they price risk and make decisions as to where and with whom they will allocate capital.

So what to do? If technology and complex challenges are on the rise while IQ is on the decline, we believe that the best opportunities for long-term growth and capital appreciation will be found in disruptive innovation. We believe such opportunities have the ability over time to transcend cognitive decline risk/ignorance risk.

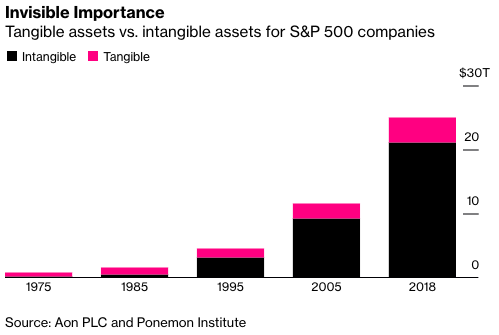

And they have. In a recent piece in Bloomberg, Sarah Ponczek found that if you took all the physical assets owned by all the companies in the S&P 500, all the cars and office buildings and factories and merchandise, then sold them all at cost in one giant sale, and they would generate a net sum that doesn’t even come out to 20% of the index’s $28 trillion value. Much of what’s left comes from things you can’t see or count: algorithms and brands and lists. This is, in the broadest sense, a new phenomenon. Intangible assets make up more than 84% of S&P 500 firm value.

So, for all the stress and worry about how the pandemic run-up in tech stocks bespeaks a bubble that’s bound to burst, what if the bigger concern is that it doesn’t?

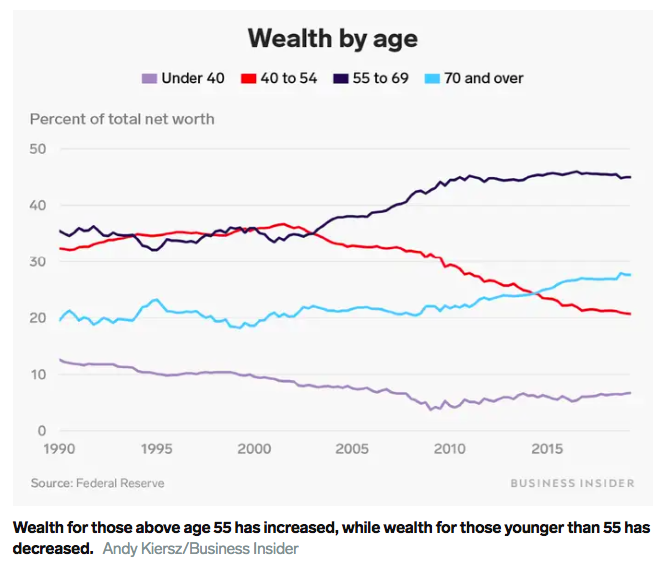

If you work at a company riding this wave or better yet own one, you’re doing well. For everyone else, the news is less good. One loose way of thinking of the impact is that while intellectual property tends to create a small set of well-to-do workers and investors, it often displaces a larger set of non-innovation focused ones.

This helps explain why many American workers have recently had it so rough, with wages stagnating and benefits disappearing. Demand for certain intangible linked skills is rising while it is dropping for almost every other skill set.

The market’s appetite for earnings based not on plants and machinery, but ideas -- feeds itself. The share of business investment targeted at intangible assets is now rising 1 1/2-times faster than it did during the financial crisis, itself a record period of hyper-investment in intangibles, estimates Jason Thomas, the head of global research at Carlyle Group.

Such spending tends to be motivated by a desire to do more with less. Our bet is that this continues. Unfortunately, if it does, it implies an uncomfortable projection for a labor market still destroyed from the shutdowns, with close to 8% of people in the U.S. unemployed and the prospect of further shutdowns looming.

In fact, the Covid-19 induced economic shutdowns should be thought of as the worst assault on the working class in half a century. Economic recoveries that focus more on intangible investments have increasingly been met with slower labor market bounce-backs and this rebound will be no different.

Innovative ideas are becoming more hard to come by and thus, we believe that big idea-based companies - those who are the leaders, enablers, and beneficiaries of disruptive innovation - will be the epicentre of attractive future returns.

Despite lockdowns, the absence of a vaccine, the presence of a Republican or Democrat in the White House, cognitive decline in the West, we are confident that remaining long big ideas will reward the patient long-term investor.

Charts of the Month

The number of business bankruptcies and insolvencies in most countries has declined this year through the coronavirus pandemic as the world is seeing far fewer bankruptcies than it did in 2019. But that is largely thanks to assistance from central banks and government measures restricting things like foreclosures.

What it means: When the smoke clears the world is likely to be looking at a sizable increase in the number of zombie companies — firms that owe more on debt than they generate in profits but are kept alive by relentless borrowing.

Why it matters: "Zombie firms are smaller, less productive, more leveraged and invest less in physical and intangible capital," the Bank for International Settlements concluded in a report last month.

"Their performance deteriorates several years before zombification and remains significantly poorer than that of non-zombie firms in subsequent years."

In other words: More zombies will lead to a slower, less efficient and less productive global economy.

Logos LP September 2020 Performance

September 2020 Return: 0.76%

2020 YTD (September) Return: 51.51%

Trailing Twelve Month Return: 67.44%

Compound Annual Growth Rate (CAGR) since inception March 26, 2014: +21.31%

Thought of the Month

"Where there is no vision, the people perish." —Proverbs 29:18

Articles and Ideas of Interest

The role of luck in life success is far greater than we realized. Are the most successful people in society just the luckiest people? The importance of the hidden dimension of luck raises an intriguing question: Are the most successful people mostly just the luckiest people in our society? If this were even a little bit true, then this would have some significant implications for how we distribute limited resources, and for the potential for the rich and successful to actually benefit society (versus benefiting themselves by getting even more rich and successful). Fascinating article in the Scientific American.

Researchers gave thousands of dollars to homeless people. The results defied stereotypes. Researchers gave 50 recently homeless people a lump sum of 7,500 Canadian dollars (nearly $5,700). They followed the cash recipients' life over 12-18 months and compared their outcomes to that of a control group who didn't receive the payment.

Trump boasts the economy reached historic heights during his first term. Here are 9 charts showing how it stacks up to the Obama and Bush presidencies.

Biden, Democratic victories would be the best outcome for the economy, Moody’s says. Biden would be allowed to enact more wide-sweeping economic policy changes such as spending trillions on infrastructure, education and social safety, while also boosting trade and immigration. “Greater government spending adds directly to [GDP] and jobs,” Zandi said, while also arguing that the higher taxes Biden has proposed to fund some of these plans have an “indirect impact” and would not slow the economy. Moody’s analysis found that a Trump victory would be a worse outcome for the economy because of his smaller proposals for fiscal stimulus and the increased likelihood of deeper trade tensions and cuts to immigration. Trump has proposed “much less expansive support to the economy from tax and spending policies,” Moody’s said, adding that his planned immigration cuts are a “significant impediment to longer-term economic growth” as it slows both the job market growth and labor productivity.

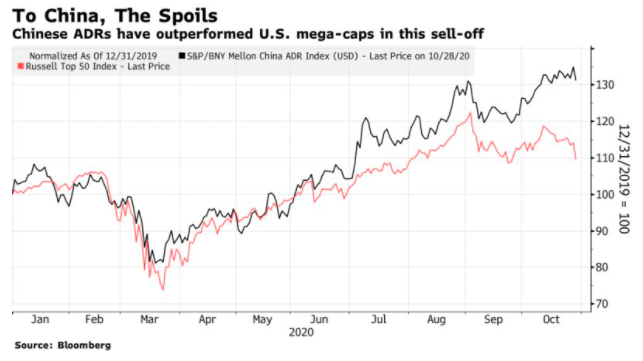

Either way, on Nov. 3, China wins. Mary Hui and Jane Li explain why Beijing is in an “enviable position” going into this US presidential election. A Joe Biden administration would likely bring some cooperation and less confrontation while a Donald Trump win might mean more short-term pain, but would also reduce America’s ability to overcome internal divisions and forge a global strategy to counter China.

Shallower pools, emptier pockets. Back in June, Donald Trump temporarily halted the H-1B visa program, which companies use to recruit highly skilled foreign workers, especially in computer science. Ananya Bhattacharya lays out how shutting 200,000 top employees out of the country shaved $100 billion off of Fortune 500 companies’ returns.

The loneliness of the long-distance employee. It takes effort to maintain camaraderie while working from home. The Great Work From Home Experiment of 2020 has gone on for nearly eight months, and preliminary results are coming in. Overall, surveys suggest that most of us like it most of the time, except for one thing: We feel lonely. “Camaraderie” is the No. 1 thing people look forward to about an eventual return to the office. “Loneliness” is often at the top of the list of downsides to remote work.

The GOP’s demographic doom. Millennials and Gen Z are only a few years away from dominating the electorate. Given that the younger generations align much more closely with Democratic ideological views on almost all policy questions, this shift underscores the stakes in the generational roulette Trump has played by defining the GOP so narrowly around the priorities and preferences of his core groups: older, nonurban, non-college-educated, and evangelical white people. If Democrats can not only express the values of younger Americans, but also advance their material interests, they will have a substantial advantage in building electoral majorities through the decade ahead, says Ruy Teixeira, a veteran Democratic election analyst and co-founder of the States of Change project, which is a joint research collaboration between three liberal-leaning groups and the centrist Bipartisan Policy Center.

Stocks typically climb, regardless of who’s in the White House. For investors worried about how the stock market will fare in the event of a divided government or a sweep by either party in next month’s elections, history offers an important lesson.

Machines to 'do half of all work tasks by 2025'. Millions more jobs will be lost to robots with Covid accelerating the trend, says the World Economic Forum.

How do pandemics end? In different ways, but it’s never quick and never neat. Just like the Black Death, influenza and smallpox, Covid-19 will affect almost every aspect of our of lives – even after a vaccine turns up.

Psyche, an asteroid believed to be worth $10,000 quadrillion, is observed through Hubble Telescope in new study. The exact composition of Psyche is still unclear, but scientists think it's possible the asteroid is mostly made of iron and nickel. It's been hypothesized that a piece of iron of its size could be worth about $10,000 quadrillion, more than the entire economy on our planet. LOL “Wealth” is such a relative concept...

Now that more Americans can work from anywhere, many are planning to move away. An astonishing 14 million to 23 million Americans intend to relocate to a different city or region as a result of telework, according to a new study released by Upwork, a freelancing platform. The survey was conducted Oct. 1 to 15 among 20,490 Americans 18 and over. The large migration is motivated by people no longer confined to the city where their job is located. The pandemic has shifted many companies' view on working from home. Facebook announced plans for half of its employees to work from home permanently. The company even hired a director of remote work in September to ease the transition. Big cities will see the largest outmigration, according to the survey. Meanwhile, Bruce Flatt the CEO of Brookfield believes things will go right back to normal. With COVID-19 cases reaching new records in the U.S. and spiking around the world, Flatt’s confidence in a return to pre-pandemic norms stands out, and it may be wishful thinking...

Our best wishes for a month filled with discovery and contentment,

Logos LP