Image Source: From Drake's Laugh Now Cry Later music video, 2020.Courtesy of UMG / Republic / OVO

Good Morning,

Stocks rose on Friday, lifted by strong U.S. economic data, to end a week that saw the broader market reach a record level.

The bull market was strong before the virus and it has now regained its stride. This week's price action confirmed that. A 55% move off the lows in five months is the quickest and strongest recovery after a BEAR market low. The comeback rally appears to be the beginning of a new bull market.

On Friday the Nasdaq hit its 35th new high in 2020 while the S&P recorded its 15th high with a close at 3,397. Both of those indices posted their fourth straight week of gains. The Dow 30 and the Dow Transports were both unchanged on the week, while the small caps as measured by the Russell 2000 fell 1.5%.

This week, concerns over a new coronavirus stimulus bill kept the market’s gains in check as party representatives appeared unable to come to an agreement on the terms of a package.

Washington continues to bicker while markets hit fresh record highs as we experience the strongest start to any month of August in 20 years.

What to make of the haters who are still singing the “too much complacency” / “a total disconnect from the real economy” / “only a handful of stocks are rising” tune?

Our Take

Below I will get into why we, as investors, are predisposed to looking out for dangers that may upset our investment plans, but first I want to point out what is being lost in neverending gloom and doom of the popular financial media.

For those who wonder why we are hitting new highs or who fear that the risk-reward is most certainly now skewed to the downside I would recall the following FACTS:

-Retail Sales hit a record high last week, and now Housing Starts and Building Permits are back to pre-pandemic levels.

-Airline passenger traffic has continued to improve off its lows from April, and the seven-day average traffic is the strongest since March 22nd.

-Adjusted for seasonal factors, the IHS Markit Flash U.S. Composite PMI Output Index posted 54.7 in August, up from 50.3 at the start of the third quarter, and signaled a strong increase in output (18-month high). Moreover, it marked the sharpest upturn in private sector business activity since February 2019.

-U.S. Services Business Activity Index at 54.8 (50.0 in July). 17-month high.

-U.S. Manufacturing PMI at 53.6 (50.9 in July). 19-month high.

-U.S. Manufacturing Output Index at 53.9 (51.7 in July). 19-month high.

Siân Jones, Economist at IHS Markit noted a strong expansion in U.S. private sector output in August:

"August data pointed to a further improvement in business conditions across the private sector as client demand picked up among both manufacturers and service providers. Notably, the renewed increase in sales among service sector firms was welcome news following five months of declines."

"Encouragingly, firms signalled an accelerated rise in hiring, as greater new business inflows led to increased pressure on capacity. Some also mentioned that time taken to establish safe businesses practices had now allowed them to expand their workforce numbers."

"However, expectations regarding output over the coming year dipped slightly from July due to uncertainty stemming from the pandemic and the upcoming election. Meanwhile, cost burdens surged higher amid reports of greater raw material prices. Although manufacturers increased their selling prices at a faster rate to help compensate, service sector firms noted that competitive pressures and discounting to attract customers had stymied their overall pricing power."

Furthermore when we move from the macro backdrop to the company level we see similar green shoots:

-We continue to see extremely strong beat rates, especially for bottom-line EPS numbers. Overall, 82% of companies have reported earnings better than expected with an aggregate earnings surprise of ~22%.

-Forward guidance continues to be as positive as investors have ever seen it, but not many analysts are talking about it.

Today, the haters state that technology stocks are in a new bubble, but the data may suggest otherwise. When compared to other sectors, the Technology sector easily has the strongest EPS beat rate this season at 87%. Industrials, Consumer Staples, and Materials have the next strongest beat rates, while Energy and Real Estate have the weakest beat rates in the 50s. Do these numbers suggest that the market is irrational?

What of the claim that technology is doing ALL of the heavy lifting and this can’t go on? Is this even accurate?

This may sound hard to believe, but the Technology sector ETF is just the sixth best performing sector in the third quarter and underperforming the S&P 500.

Industrials, Consumer Discretionary, Materials, and Communication Services are all posting double-digit percentage gains this quarter. With Consumer staples posting a 9+% gain, that is also higher than the 8.8% gain for the Technology sector in Q3.

The S&P is also up 9+% for the quarter. Let's not forget that Small Cap Growth, Small Cap Value, and Mid Cap value are also posting double-digit percentage gains in Q3 as well…

What about the general claim that the market is overpriced? The S&P 500 is trading at 10% above its 200-day moving average, similar to where it traded in February and at other previous market highs so there isn’t much new to see here yet what of the claim that the market is overvalued?

This appears to be a popular opinion as cash on the sidelines continues to to hit record highs. The double dip narrative appears to be gaining steam with every new fresh record high. Are stocks overvalued? The following tweet offers some insight:

Barry’s tweet is a reminder that classic “quick and dirty” valuation tools such as PE multiple should be relied upon with caution. What “expert” truly has any idea how high the PE multiple should be with an unlimited level of monetary stimulus and backstop of credit from the Fed? What investor has been here before?

At minimum, it isn’t unreasonable to assume that the multiple should NOT be in line with historical norms. Therefore, the overvaluation “models” many investors and classical “value investors” cling to simply cannot hold the same weight they did with the 10-year Treasury at 0.68% when the historical norm is well above 5.0% (see Morgan Housel’s article below on Expiring Skills vs. Permanent Skills).

In fact, Kai Wu of Sparkline capital has put together an interesting research report which suggests that classical “value investing” has a long and distinguished pedigree but is currently in a deep thirteen-year drawdown as its “models” have rotated such investors into a massive losing bet against technological disruption.

This is not the time for dogma. The old playbooks should at minimum be questioned. More than ever before, espousing a flexible approach is required. Inspiration from the old and appreciation for the new is a must as the “New” economy becomes THE economy.

Membership to Exclusive Daily Newsletter

We have launched an exclusive daily newsletter including actionable daily insights for DIY investors from Logos LP

Each Digest Contains the Following:

Key Market Technicals

Logos LP Watchlist

Macro News

Logos LP Update

Alerts

Membership will initially be limited to 1000 members. Please subscribe here.

Musings

I recently heard Drake’s new hit single “Laugh Now Cry Later,” on which Drake and Lil Durk rap about the high-life they live hoping to live in the moment and deal with pain and troubles later. As usual, Drake has aptly captured the spirit of the moment at a time when it appears that governments and central banks around the world are engaging in ever increasing monetary and fiscal stimulus that favors immediate pleasure, pushing pain and troubles to some future date for some future generation.

The deficit spending for the U.S. is over $3 trillion so far this year and for Canada, close to $75 billion. While the costs are clear, the benefits are less so. Financial relief for millions of Americans and Canadians furloughed or unemployed has certainly been a short-term humanitarian gift but what about the future?

As both governments in the USA and Canada look to additional government spending they must acknowledge the fact that monetary and fiscal spending have not generated significant growth over the past decade.

As Michael Farr suggests, “our current efforts continue to make the same mistakes. There are two primary mistakes: one, while surges of liquidity can stave off economic collapse, and provide needed relief, they have little ability to stimulate sustained growth. When growth doesn’t come, policy makers add more stimulus. Two, cheap money has increased supply and done little to increase demand.”

The injections over the past ten years of QE haven’t created any multiplier effect. A trillion dollar injection results in a one-time trillion dollar surge and another trillion in debt because the U.S. doesn’t have an extra trillion lying around somewhere (the USA hasn’t run a surplus since the 1990s).

Instead, the dollars should be funnelled to things that will grow and create jobs and increase over time. In short, there needs to be a clear ROI on future spending beyond the payment of another month’s rent or mortgage. This is the kind of investment that successful private industry and individuals would make.

Unfortunately, policy makers have chosen to continue on a kind of willfully blind panglossian adventure in which they take the recipients of stimulus to an amusement park only to have them return to their same old same old. While at the park they feel pretty good. They temporarily forget their struggles and pain as they live the highlife only to return out another trillion in cash. When the high fades, a weak business pre-pandemic is still a weak business, a poor/precarious skill set/job is still a poor/precarious skill set/job.

Instead, policy makers will need to have the courage to confront the harsh realities of this “Laugh Now Cry Later” economy. The rapid adoption of remote work and automation is accelerating inequalities which were in place well before the pandemic. The resulting ‘K’ shaped recovery has been and will continue to be good for professionals with the right skills who are largely back to work, with stock portfolios approaching new highs—and bad for everyone else.

The stimulus dollars as they are currently being deployed are not addressing this reality. Over the past ten years to today, the economy has no longer been creating steady jobs for low-skilled, low-wage workers as fast as it once was. Things will not go back to the way they were. No amount of protectionism or taxation of the hyper-rich will make it so.

Alternatively, if policy makers are to have a chance at stimulating the kind of sustained growth we need, they will need to acknowledge that not all skills, jobs and businesses are created equal. Certain uses of capital and certain skills have higher ROIs than others.

They will need to be more discerning capital allocators if they wish to stimulate a generation of producers, earners, consumers, tax payers, creative innovators and problem solvers that would better the future for generations to come.

Sadly, looking at the sorry state of the current political discourse, such courage appears to be in short supply.

After all, perhaps given how uncertain the future now looks and how much harder it will be for most to make a buck, many may be satisfied with what they can get. Even if it’s just a free trip to Wonderland…

Charts of the Month

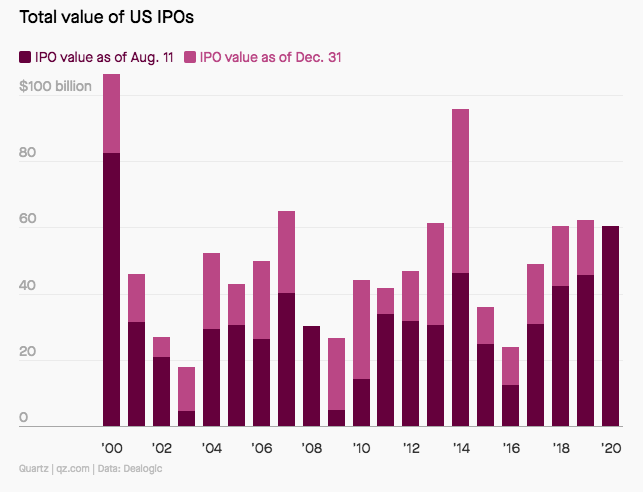

After slowing to a trickle in March, public listings roared back and are now on pace to reach their highest levels since the peak of the dot-com boom in 2000.

Robot subsidy: Payroll and related taxes have held steady over the past 40 years, but the effective tax rate on automation has fallen. Translation: Economists argue we are now subsidizing the replacement of humans with robots, even when robots aren't as productive.

Logos LP July 2020 Performance

July 2020 Return: 4.77%

2020 YTD (July) Return: 51.44%

Trailing Twelve Month Return: 59.30%

Compound Annual Growth Rate (CAGR) since inception March 26, 2014: +21.91%

Thought of the Month

"“The worst loneliness is to not be comfortable with yourself.”– Mark Twain

Articles and Ideas of Interest

Even a global pandemic can’t slow the US IPO market down. After slowing to a trickle in March, public listings roared back and are now on pace to reach their highest levels since the peak of the dot-com boom in 2000.

After tapping the bond market at a record-shattering pace in recent months, Corporate America is more indebted today than ever before. And while much of that fresh cash -- more than $1.6 trillion in total -- helped scores of companies stay afloat during the pandemic lockdown, it now threatens to curb an economic recovery that was already showing signs of sputtering. Many companies will have to divert even more cash to repaying these obligations at the same time that their profits sink, leaving them with less to spend on expanding payrolls or upgrading facilities in months ahead. Leverage ratios have never been higher for U.S. companies.

Scientists discover a major lasting benefit of growing up outside the city. As the recession is predicted to slam cities and many rush to leave them, the data seems to support the move. Using data from 3,585 people collected across four cities in Europe, scientists from the Barcelona Institute for Global Health (also called IS Global) report a strong relationship between growing up away from the natural world and mental health in adulthood. Overall, they found a strong correlation between low exposure to nature during childhood and higher levels of of nervousness and feelings of depression in adulthood. Co-author Mark Nieuwenhuijsen, Ph.D., director of IS Global’s urban planning, environment and health initiative, tells Inverse that the relationship between nature and mental health remained strong, even when he adjusted for confounding factors.

What if we could live for a million years? Past generations used to say that even though we cannot postpone natural death, we can control how we live. They also believed that there is “nothing new under the sun.” Both statements are inaccurate from our current perspective. With advances in bioscience and technology, one can imagine a post-COVID-19 future when most diseases are cured and our life span will increase substantially. If that happens, how would our goals change, and how would this shape our lives? Fascinating article in the Scientific American outlining what a post-death world could look like.

Is inflation really what we should be worrying about? With many pundits pushing gold as their investment of choice, deflation remains the bigger danger from the collapse in global demand, rather than a surge in inflation.

Delisting Chinese Firms: A cure likely worse than the disease. Interesting article by Jesse Friend suggesting that if the proposed legislation becomes law, its cure could be worse than the disease. Both Chinese controlling shareholders and the Chinese government are likely to exploit such a trading ban to further their own objectives, at the expense of Americans holding shares in these firms.

The unstoppable Damian Lillard is the NBA superstar we deserve. He’s lifted his game to new heights inside the NBA bubble, but what sets the Trail Blazers’ point guard apart is the fierce loyalty and outsider spirit that’s driven him from the start. His unwillingness to run from “the Grind” is an inspiration.

The unravelling of America. Interesting perspective (albeit a bit depressing) on America by anthropologist Wade Davis in the Rolling Stone in which he suggests that COVID has reduced to tatters the illusion of American exceptionalism. At the height of the crisis, with more than 2,000 dying each day, Americans found themselves members of a failed state, ruled by a dysfunctional and incompetent government largely responsible for death rates that added a tragic coda to America’s claim to supremacy in the world. Using compelling data and the historical context of other great empires, he paints a picture of a country in decline. Nothing lasts forever - perhaps America’s best days are behind it?

Expiring vs. Permanent Skills. Morgan Housel knocks it out of the park with this one in which he explains that every field has two kinds of skills: Expiring skills, which are vital at a given time but prone to diminishing as technology improves and a field evolves. Permanent skills, which were as essential 100 years ago as they are today, and will still be 100 years from now. Both are important. But they’re treated differently. Expiring skills tend to get more attention. They’re more likely to be the cool new thing, and a key driver of an industry’s short-term performance. They’re what employers value and employees flaunt. Permanent skills are different. They’ve been around a long time, which makes them look stale and basic. They can be hard to define and quantify, which gives the impression of fortune-cookie wisdom vs. a hard skill. But permanent skills compound over time, which gives them quiet importance. Morgan provides an excellent list of certain key permanent skills applicable to many fields.

Our best wishes for a month filled with discovery and contentment,

Logos LP