Good Morning,

Stocks remained in a holding pattern on Friday after China and the U.S. agreed to a phase one trade deal as investors concluded a decent week of gains.

The trade deal will include a rollback of some of the China tariffs and halts additional levies set to take effect on Sunday. China agreed to significant purchases of U.S. agricultural products, but the amount is below what the White House was reportedly pushing to get. On the U.S. side, investors were hoping for more than just a partial rollback of some tariffs.

The US markets sit at record highs and it would appear that the probability of Christmas 2019 being cancelled like Christmas 2018 is low.

Our Take

Although markets both in the US and around the world seemed to rejoice at the progress made on a phase one trade deal upon further inspection this appears to be another baby step.

As part of the “phase one” deal, the U.S. canceled plans to impose fresh tariffs on $156 billion in annual imports of Chinese made goods-including smartphones, toys and consumer electronics-that were set to go into effect Sunday. The U.S. also slash the tariff rate in half on roughly $120 billion of goods, to 7.5% from 15%.

Nevertheless, tariffs of 25% would remain on roughly $250 billion in Chinese goods, including machinery, electronics and furniture.

Chinese officials said the U.S. has agreed to reduce these tariffs in stages, but U.S. Trade Representative Robert Lighthizer said there was no agreement on that, and he suggested China believes such reductions can be negotiated in subsequent phases.

For its part, China will boost American agricultural purchases by $32 billion over previous levels over the next two years. That would increase total farm-product purchases to $40 billion a year, with China working to raise it to $50 billion a year.

The agricultural purchases are part of a package designed to raise U.S. exports to China by $200 billion over two years, Mr. Lighthizer siad.

Mr. Lighthizer said that China made specific commitments on intellectual property but these would be announced in the future.

Many trade experts expected the U.S. to eliminate the tariffs imposed on retail goods on Sept. 1 or roll back more tranches of tariffs (there are currently 4 tranches in play), rather than merely halving the September tariff rates.

So to recap we basically have a saving face ceasefire to further tariff escalations with question marks around most of the most important aspects of the dispute.

Nevertheless, it should be seen as a positive for stocks since it could boost business confidence and that could spill over to more investment spending and higher corporate profits. In our view this confidence will likely depend on being able to tell businesses not only that tariffs are not going up but that they are going down...

Both countries have agreed to stop punching themselves in the face; but how much better if they hadn’t started at all...

From what we can see, there is nothing in this tentative deal that wouldn’t have existed in the absence of the past two years of trash talking.

Looking at the record highs in global stock markets, it’s tempting to think that none of this really matters. But it’s worth considering how much of these returns are attributable to the global synchronization of dovish monetary policy which has cushioned a deteriorating geopolitical picture in addition to job growth which has remained strong and consumers who have continued to spend.

Although things look better now than they did in the summer, global growth in 2019 will still be the weakest since the financial crisis of 2008 and 2009, according to the International Monetary Fund, and China and the U.S. will both slow next year. With paralysis at the World Trade Organization, we could be closer to the beginning than the end of the troubles in the global trading system.

While times are good a trade fight is all fun and games. Unintended consequences are ignored, swept under the rug and to the victor go the spoils! Yet when times turn bad and the tide rushes out, those not wearing a bathing suit may finally be exposed to the merciless disdain of the crowd...

Stock Ideas

In our last newsletter update we suggested a few companies we are evaluating for addition to our portfolio. We received positive feedback on the inclusion of such picks and thus we thought we would follow things up with a few updates and picks:

UPLD (Upland Software): We still think Upland is a compelling buy here. With the recent results we saw from Enghouse, we think that fiscal '20 will be a good year for the consolidators. With a plethora of VC investments ending up as zombies (and more to come as capital becomes more disciplined), we think there is a robust pipeline in niche work management cloud companies (think software that tracks consumer sentiment when you call your telco to complain about your bill). At 3.8x sales, 13x forward PE and 4.1x book, the company is not trading at a premium valuation considering it is a consolidator with rapidly growing revenue in a highly fragmented software market. We have initiated a position and will look to add on further weakness.

BOMN (Boston Omaha): This is another serial acquirer of an asset class that is peculiar: billboards. Billboards provide surprisingly high ROIC (not digital ones but rather regular old fashioned billboards) and have tremendous cash flow conversion. This company utilizes cash flows from billboards and invests them into other high quality companies a la Berkshire (surety insurance, bail bond insurance and municipal bond insurance companies). They also made a significant investment in Dream Homes, a niche home builder, and a regional bank. They are rapidly growing revenue and have a strong management team that has an ROIC-focused culture. Also, board members aren't paid much and all senior execs plus board members are required to purchase company stock. Stock is down over 15% this year, trading at 2017 levels and we think this presents an attractive entry point.

ATRI (Atrion): The small cap maker of fluid pumps and medical devices is having a tough Q4 as the trade deal made for a volatile period of time. The company reported slowing growth last quarter (especially in Asia) which sent the stock tumbling. Currently, the stock is trading below 50, 100 and 200 moving day average and is well off highs. With high ROIC (over 18% 5-year average) and a dividend increase of roughly 15% we think Atrion offers compelling value for the long term given the recent underperformance. We have initiated a position and will look to add on further weakness.

Musings

Came across an interesting chart this month:

Apparently most people’s reading of the data and thus views on the economic outlook are highly correlated to their political bias.

Thus, it is no surprise that many democrats I’ve had discussions with have largely sat the rally out since Trump’s inauguration or worse have remained completely on the sidelines assuming the U.S. economy is headed for Armageddon under the current administration.

This sentiment was recently confirmed by the following data: “Sixty-five percent of Americans say a recession is likely in the next year — 84% of Democrats, 72% of Independents and 46% of Republicans.”

This kind of decision making based on political bias is dangerous but oh so common. Why?

Many possible explanations can be found in the realm of behavioural economics, but one I came across recently that is particularly illuminating: “Manson’s Law”.

The law states that:

“The more something threatens your identity, the more you will avoid it.”

Mark Manson explains: “that means the more something threatens to change how you view yourself, how successful/unsuccessful you believe yourself to be, how well you see yourself living up to your values, the more you will avoid ever getting around to doing it.”

The world is a noisy place. On a daily basis we are bombarded with a plethora or people, activities and data. In light of this noise, we as humans find a certain comfort in knowing how we fit in the world.

Anything that disturbs that comfort, threatens it or destabilizes it- even if it could potentially make our lives better (ie. learning something new, enriching us, challenges us to grow)- is inherently “scary”.

What is fascinating about this law is that it applies to both good and bad things. Working hard earning thousands or even millions could threaten your identity as someone with grievances against the wealthy as much as failing in some way, losing all of your hard earned money could threaten your identity as a “successful” person.

This is why people are often so afraid of success for the same reason they are afraid of failure: “it threatens who they believe themselves to be”.

A few common examples of this phenomenon:

You don’t invest in the stock market and ignore a favorable earnings, revenue and macro backdrop because it could threaten your identity as a Trump hater, staunch democrat, civil rights/99% advocate or simply as a bear who keeps trying to call “the top”. Result: you miss out on years of gains and can’t retire because you’ve failed to generate adequate returns.

You don’t invest in the stock market and ignore the data that stocks outperform real estate over the long term because it could call into question your identity as someone who puts their nest egg in real estate like everyone you know. Result: your retirement is hoo-hum because you’ve failed to generate any significant returns creating cash-flow issues.

You don’t wind up a failing business venture with obviously bad unit economics because that would call into question your identity as a high-flying “successful” tech entrepreneur. Result: you tax your life by a few years and burn your investor capital in addition to your reputation.

You avoid telling your significant other that you feel the two of you are not a fit because ending the relationship would threaten your identity as a nice, loyal boyfriend in a “good relationship”. Result: you tax your life, miss out on meeting someone who is a great fit and both you and your significant other become bitter and resentful.

These are only a few common examples yet they illustrate the point that we consistently pass up important opportunities because they threaten to change how we view and feel about ourselves. They threaten the values that we’ve learned to live up to and which anchor our lives and conceptions of self.

We protect these values. We avoid opportunities and people that threaten them. We surround ourselves with people and opportunities that will reinforce them.

I was walking down the street recently and saw a sign on a high school which advertised the school as a place where the students can “find themselves”. This is the zeitgeist of the times.

The problem with this tired trope is that most people find themselves and never let go…

In a way, what we should consider is never finding ourselves. This is what keeps us learning and growing. Seeing ourselves as a canvas that is never really complete can keep us humble and open to new places, opportunities and people.

Instead of anchoring to our existing beliefs and then trying to prove them right, we should consider chipping away at the ways in which we are wrong one day so that we will be a little less wrong the next…

What are we wrong about today that can lead to our improvement tomorrow?

Charts of the Month

Maybe things aren't so bad?

Does the future belong to Millennials?

Stock picking can be rewarding...

Logos LP November 2019 Performance

November 2019 Return: 9.63%

2019 YTD (November) Return: 37.70%

Trailing Twelve Month Return: 28.16%

Compound Annual Growth Rate (CAGR) since inception March 26, 2014: +16.04%

Thought of the Month

"Everything is passing. Enjoy its momentariness.” – Mooji

Articles and Ideas of Interest

Kids are expensive. How expensive? Forget retiring any time soon—or maybe ever—if you’re considering raising multiple children. According to Investopedia: Parents tend to underestimate the cost, even of that first year, as a recent survey by personal finance website NerdWallet points out. The actual cost of raising a baby in its first year is around $21,000 (for a household earning $40,000) and $52,000 (for one bringing home $200,000). According to the poll, 18% of parents thought it would cost $1,000 or less and another 36% put the price tag at between $1,001 and $5,000. You’re going to pay a lot of money for that cute little bundle – somewhere around $233,610 by the time the baby turns 18, according to a 2017 Department of Agriculture (USDA) study.

Hippie Inc: How the counterculture went corporate. The Economist explores how half a century on from the summer of love, marijuana is big business and mindfulness a workplace routine. Nat Segnit asks how the movement found itself at the heart of capitalism.

The bad news about women on boards. Research suggests investor bias penalises companies when they make diverse appointments. As reported in the Financial Times: “When Isabelle Solal and Kaisa Snellman looked at 14 years’ worth of data from more than 1,600 US public companies, they made a disturbing discovery: businesses that put a woman on the board then suffered a two-year decline in their market value. Worse, the penalty was greater for companies that had splashed out on measures to boost diversity, such as better work-life balance policies. Their market value fell by nearly 6 per cent after a woman joined the board.” Why? The researchers found that investors think boosting board diversity is a sign that a company is more interested in social goals than maximising shareholder value...

The most dangerous of all people is the fool who thinks he is brilliant. We all suffer from overconfidence at times (some with more frequency than others) yet Jason Zweig does an excellent job in this piece of reminding us of the blunders that can stem from presuming we know more than we do, more than the people around us, more than the people who came before us, more than the people who have spent decades studying a topic or working in a field. The dangers of underestimating the difficulty of problems and overestimating the ease of solutions.

How much runway should a founder target between financing rounds? According to CBInsights, running out of cash is the second leading cause of startup failure. Needless to say—it’s an important question to get right. Is it possible that the startup failure rate is so high partially because conventional wisdom tells founders to prepare for 12-to-18 months between financing events when in reality they should be preparing for longer as the experienced VCs suggest? Sebastian Quintero ingests all of Crunchbase’s data to find out. His team finds that it possible that the conventional wisdom of 12 to 18 months between financing events is an influential factor leading to high startup failure rates as the hard data says entrepreneurs should plan for at least 18–21 months of runway, and as much as ~35 months if they want to play it safe and stay within one standard deviation from the mean.

OK Boomer, Who’s Going to Buy Your 21 Million Homes? Baby boomers are getting ready to sell one quarter of America’s homes over the next two decades. The WSJ reports that the problem is many of these properties are in places where younger people no longer want to live. If demand the demand isn’t what everyone said it would be, what happens to prices? Think steep discounts — sometimes almost 50%, and many owners end up selling for less than they paid to build their homes. What then happens to retirement?

The American Dream is killing us. Mark Manson puts together an interesting review of American history suggesting that from a unique intersection of good fortune, plentiful resources, massive amounts of land, and creative ingenuity drawn from around the world that the idea of the American Dream was born. He holds that the American Dream is simple: “it’s the unwavering belief that anybody — you, me, your friends, your neighbors, grandma Verna — can become exceedingly successful, and all it takes is the right amount of work, ingenuity, and determination. Nothing else matters. No external force. No bout of bad luck. All one needs is a steady dosage of grit and ass-grinding hard work. And you too can own a McMansion with a three-car garage… you lazy sack of shit.” And in a country with constantly increasing customers, endlessly expanding land ownership, endlessly expanding labor pool, endlessly expanding innovation, this was true. Until recently…

If you can manage a waffle house you can manage anything. A day doesn’t go by without us hearing about some “high-flying”/”high-tech” company raising capital. The founders are excited (yet have no experience in the space), everyone is excited and the space is “ripe” for disruption (yet no one has done a proper analysis of the business’s unit economics). What most don’t hear about or conveniently forget is that a year of two later the founders are looking to wind the thing up. The WSJ pens a refreshing article suggesting that running a 24-hour budget diner isn’t glamorous, but it forces leaders to serve others with speed, stamina and zero entitlement. What if all founders operated with zero entitlement? Now that would be an exciting “disruption”...

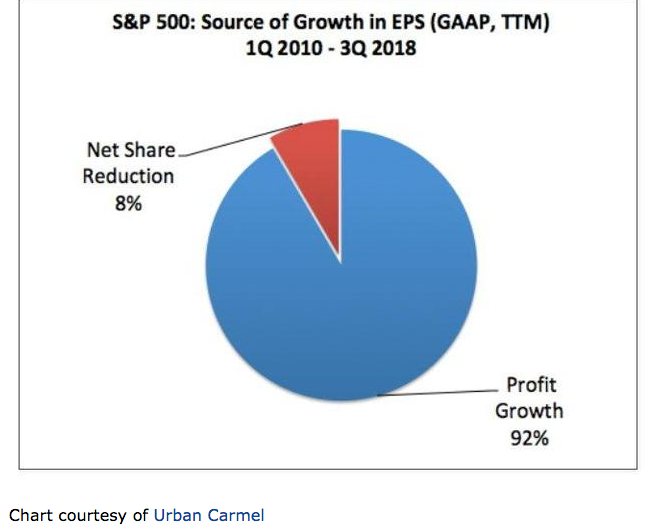

What powered such a great decade for stocks? This formula explains it all. This is a nice follow up to our last newsletter entitled “Haters Gonna Hate”. Market Returns = Dividend Yield + Earnings Growth +/- Changes in the P/E Ratio. Contrary to popular belief, Ben Carlson demonstrates that a vast majority of the gains over the past decade can be explained almost exclusively by improving fundamentals. Yes that's right the market isn’t a ponzi scheme a product of financial engineering, stock buybacks and central bank money printing! Earnings growth and dividends explain nearly 97% of the annual returns for the 2010s. Many would argue the only reason earnings growth has been so strong is because of the massive stimulus we’ve received from low interest rates. Ben isn’t saying valuations haven’t risen in this time (they have). It’s just that they’ve risen in concert with corporate profits.

A mysterious voice took over investing. I know what it is. The Institutional Investor examines the link behind the decline of value, hedge funds and alpha everywhere. Since the 2008 crisis, the Standard & Poor’s 500 Growth Total Return Index has beaten its Value Total Return counterpart in eight of 11 years, including 2019 for the year to date. Growth has put up average annualized returns of 9.4 percent in the decade since the crisis, versus just 5.6 percent for value. Worse, value has suffered through three negative years during that span, whereas the growth index has not experienced a single one. Spoiler: data and the rise of the machines. We simply cannot compete with this computational supremacy. Our human brains, about 1,260 cubic centimeters on average, have been essentially unchanged for nearly 200,000 years.

Our best wishes for the happiest of Holidays filled with joy and gratitude,

Logos LP