Good Morning,

The S&P 500 closed at a record Friday, helped by gains in technology stocks on the last trading day of the quarter. The tech-heavy Nasdaq composite rose more than half a percent to post its 50th record close for this year. The Dow transports and small-cap Russell 2000 also hit record highs.

The Dow posted quarterly gains of 4.9 percent its eighth straight quarter of gains for the first time since 1997. The S&P 500 rose nearly 4 percent in the quarter, also its eighth straight quarter of gains. The Nasdaq composite gained almost 5.8 percent for the quarter, its fifth straight positive quarter since 2015.

Our Take

Strength begets strength. Virtually every asset class is moving up. New record highs are being made in virtually every corner of the market. We suggest remaining cautious as positive sentiment is building.

Of note this week this week was the announcement surrounding Trump’s tax reform. As expected it was thin on details and appeared to favor the rich. On a first read it is likely to increase the U.S. budget deficit but beyond that, its impact is still unclear. Excellent piece in the Washington Post from Bruce Bartlett who was a domestic policy advisor to President Ronald Reagan (Mr. Tax cut) questioning whether tax cuts stimulate growth. Tax cuts are still the GOP’s go-to solution for nearly every economic problem and extravagant claims are made for any proposed tax cut. Bruce looks into whether they hold water.

Musings

Over the last few weeks I’ve been busy setting up a new venture yet I finally found some time to get to a staple in the value investor’s library: The Education of A Value Investor by Guy Spier. What a breath of fresh air in my increasingly busy world.

What was so refreshing about the book was that it wasn’t what I’d been expecting. As the esteemed manager of Aquamarine Fund I figured Guy would spend a considerable amount of time on his stock selection approach yet the book offers something much more valuable.

This is a book about life. About Guy’s life. Guy’s education. Guy’s path and Guy’s alone. This point teases out its key piece of wisdom. We spend so much time trying to compete with others. Looking for their acceptance and adoration failing to realize that true success in life, true fulfillment can only occur through the acceptance of self.

Once we shift from orienting ourselves towards an outer scorecard towards an inner scorecard we can become aligned with ourselves. Authenticity is a powerful force. Guy’s story is the story of this shift. It is the story of the magical success one can have when one becomes aware of one’s own values and perspectives.

This message really spoke to me at this particular point in time as I’m starting to realize that the outer journey we start at birth; going to school, learning how to build friendships, learning how to navigate relationships, deciding what to take in school, getting our first jobs, navigating heart aches and let downs is only the starting point. The real growth occurs when we are able to drive ourselves toward the inner journey of spiritual development and self-awareness.

In our early years we are often driven by the outer scorecard - that need for public approval and recognition, which can easily lead us in the wrong direction. Come to think of it, many of the mistakes (perhaps all of them) I’ve made in my life have occurred because of my pursuit of this outer scorecard.

What I’ve realized and what Guy so eloquently posits is that the inner journey is not only more fulfilling but is also a key to becoming a better investor. If we don’t understand our inner landscapes - including our fears, insecurities, desires, biases, and attitude to money- we’re likely to get run over by reality. As such it is important to look within:

Are we the same people on the outside as we are on the inside? Are we pretending to be something we aren’t? Are we building a rock-solid understanding of who we are and how we want to live? Are we building environments in which we can operate rationally and calmly? Do our friends support and stimulate the authentic version of ourselves? Why are we building wealth?

The outer journey may bring us to money, professional advancement or social cachet yet the inner journey, the one we also start at birth is the one that puts us on a path toward something less tangible yet more valuable. The inner journey is the path to becoming the best version of ourselves that we can be, and this appears to me to be the only true path in life. It leads us closer to finding the answers to the real questions that matter: What is my wealth for? What gives my life meaning? And how can I use my gifts to help others?

Logos LP in the Media

Forbes has done a special feature on Canadian Investment Opportunities and we offer one of our ideas.

Thought of the Week

"This became my own goal: not to be Warren Buffett, but to become a more authentic version of myself. As he had taught me, the path to true success is through authenticity.”-Guy Spier

Articles and Ideas of Interest

- Successful investing isn’t easy. They say a picture is worth a thousand words, but in investing it is worth so much more. Check out this great collection of extreme charts as a helpful reminder that there is no such thing as "can't", "won't," or "has to" in markets. The market doesn't have to do anything, and certainly not what you think it "should" do. The market doesn't abide by any hard and fast rules; it does what it wants to do and when it wants to do it. That's what makes it so hard and at the same time so interesting.

- The plastic fantasy that’s propping up the oil markets. Kenya's mountains of plastic bags might not seem central to oil's grand narrative, but they are. Last week, the East African country banned almost everything about them: making them, importing them, selling them, using them, with penalties of up to four years in jail or fines up to $38,000. This type of prohibition carries a warning for an oil business that's depending on petrochemicals -- and the plastics made from them -- to pick up the slack when we all switch from gas guzzlers to electric cars. Petrochemicals are seen as the strongest source of global oil demand growth in 2015-2040. On the current track, by 2050 our oceans could contain more plastics than fish (by weight), according to a 2016 report by the World Economic Forum and the Ellen MacArthur Foundation. But, as Kenya shows, the days of single-use plastic packaging may already be numbered. And with this stuff making up about a quarter of all the plastic used, that will have a profound impact on the petrochemicals industry. Let’s not forget that there is now a Great Pacific Garbage Patch that is estimated to be about the size of Texas while a new report (dug into by National Geographic) has shown that extreme weather, made worse by climate change, along with the health impacts of burning fossil fuels, has cost the U.S. economy at least $240 billion a year over the past ten years...Can the oil industry really avoid disruption?

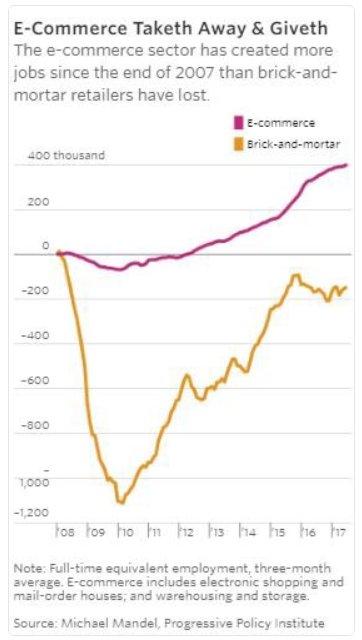

- Brace yourself: the most disruptive phase of globalization is just beginning. Great piece in Quartz covering Richard Baldwin’s new book The Great Convergence: Information Technology and the New Globalization. Baldwin argues that globalization takes shape in three distinct stages: the ability to move goods, then ideas, and finally people. Since the early 19th century, the cost of the first two has fallen dramatically, spurring the surge in international trade that is now a feature of the modern global economy. A better understanding of globalization is more urgent than ever, Baldwin says, because the third and most disruptive phrase is still to come. Technology will bring globalization to the people-centric service sector, upending far more jobs in rich countries than the decline in manufacturing has in recent decades. Baldwin argues that we shouldn’t try and protect jobs; we should protect workers. It’s really a fool’s errand to struggle with “protecting jobs” because after a year or two those jobs will still go. Governments should instead focus on comprehensive retraining, help with housing, help with relocation.

- Some market myths hurt investors. Nice piece by Ben Carlson looking over some of the rules of thumb and aphorisms that investors accept without investigating their merits based on the historical evidence: Low volume rallies spell trouble for stocks, There is tons of cash on the sidelines, Margin debt at all-time highs mean euphoria in the markets, Something’s gotta give between stocks and bonds, Bonds always lose money when interest rates rise.

- Do tax cuts really equal growth? Excellent piece in the Washington Post from Bruce Bartlett who was a domestic policy advisor to President Ronald Reagan (Mr. Tax cut). Tax are still the GOP’s go-to solution for nearly every economic problem. Extravagant claims are made for any proposed tax cut. Do they hold water?

- The shorter your sleep, the shorter your life: the new sleep science. Leading neuroscientist Matthew Walker on why sleep deprivation is increasing our risk of cancer, heart attack and Alzheimer’s and what you can do about it. We are in the midst of a “catastrophic sleep-loss epidemic”, the consequences of which are far graver than any of us could imagine. More than 20 large scale epidemiological studies all report the same clear relationship: the shorter your sleep, the shorter your life. To take just one example, adults aged 45 years or older who sleep less than six hours a night are 200% more likely to have a heart attack or stroke in their lifetime, as compared with those sleeping seven or eight hours a night (part of the reason for this has to do with blood pressure: even just one night of modest sleep reduction will speed the rate of a person’s heart, hour upon hour, and significantly increase their blood pressure).

- Education isn’t the key to a good income. The Atlantic presents a growing body of research which debunks the idea that school quality is the main determinant of economic mobility.

- The secret to Germany’s happiness and success: Its values are the opposite of Silicon Valley’s. To Germans, caution and frugality are signifiers of great moral character. Moreover, for Germans, a good work-life balance does not involve unlimited massages and free meals on the corporate campus to encourage 90-hour weeks. Germans not only work 35 hours a week on average—they’re the kind of people who might decide to commute by swimming, simply because it brings them joy.

Take some time to enjoy the scenery. Check out The Atlantic’s coverage of the 2017 National Geographic Nature Photographer of the Year Contest.

Our best wishes for a fulfilling week,

Logos LP