Good Morning,

Welcome to 2017. We hope that you all had a restful holiday.

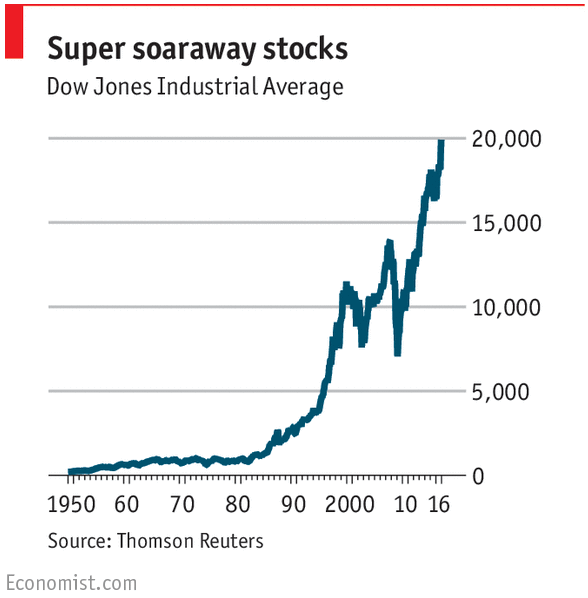

U.S. equities closed higher after hitting all-time highs on Friday as the technology sector led, while investors parsed through key employment data.

The Dow also came within 0.37 points of hitting 20,000 for the first time. The S&P 500 gained 0.35 percent and posted intraday and closing record highs, with information technology advancing 1 percent.

The U.S. economy added 156,000 jobs in December, according to data from the Bureau of Labor Statistics. Economists polled by Reuters expected an increase of 178,000. The unemployment rate came in at 4.7 percent, in line with expectations. On balance this was a good report as forward momentum remains intact.

Nevertheless, certain investors are getting nervous about all the money pouring into U.S. stocks. We would agree.

Our Take

For our humble reflections on 2016 and our thoughts on where economies/markets are and where they may be headed in 2017, we have published the outlook half of our annual letter to our unit holders. You can find it here.

Teaser:

“2016 proved to be a good year for the "active" investor and 2017 will unfold similarly as 3 big picture investment themes suggest continued volatility and divergence.”

*If you would like to read a copy of our entire 18 page annual letter to our unit holders please contact us. In it you will find a detailed description of our investment approach, our activities in 2016 as well as out outlook for 2017.

Musings Special: How Have Our Picks Performed Since Publication?

A lot of managers and analysts make stock picks yet are they held accountable? Here is a performance report card of the publicly disclosed (published) picks we made in 2016:

Marathon Petroleum (NYSE: MPC) - Total Return since January 21st, 2016: +27.23%

IBM (NYSE: IBM) - Total Return since January 11th, 2016: +32.09%

Global Brass and Copper Holdings Inc. (NYSE: BRSS) - Total Return since January 13, 2016: +62.49%

Jack Henry & Associates Inc. (NASDAQ: JKHY) - Total Return since January 26th, 2016: +18.64%

Credicorp (NYSE: BAP) - Total return since March 1st, 2016: +41.88%

Munro Muffler (NASDAQ: MNRO) - Total Return since March 18th 2016: -15.16%

Dorman Products (NASDAQ: DORM) - Total Return since March 18th 2016: +30.93%

Rocky Mountain Dealerships (TSE:RME) - Total Return since April 7th, 2016: +65.36%

Teledyne Technologies (NYSE: TDY) - Total Return since April 22, 2017: +34.44%

Renasant Corp (NASDAQ: RNST) - Total Return since April 24th, 2016: +23.47%

Agrium (TSE: AGU) - Total Return since August 26th, 2016: +18.59%

Enghouse Systems (TSE: ENGH) - Total Return since August 26th, 2016: -0.43%

Luxoft (NYSE: LXFT) - Total Return since August 26th, 2016: +19.93%

Cal-Maine Foods (NASDAQ: CALM) - Total Return since September 14, 2016: -1.49%

J.M. Smucker (NYSE: SJM) - Total Return since since September 14, 2016: -3.1%

If you had bought 1 share of each of these companies upon publication and held until Jan 6, 2017 your portfolio would have returned roughly: +23.65%

This year we have again provided the MoneyShow with our top 4 picks for 2017. Unfortunately, they are scheduled to be published next week so we will provide you with the links in the next letter. The picks are:

Peter Mantas:

Huntington Ingalls Industries (NYSE: HII): +5.05% YTD

Cemex SAB de CV (NYSE: CX): 0% YTD

Matthew Castel:

Aaron Inc. (NASDAQ: AAON): -1.06 YTD

Syntel (NASDAQ: SYNT): +3.03% YTD

How Did Logos LP Perform In 2016?

As of December 30st 2016 on a total return basis for the year, Logos LP has returned 22.9% in CAD whereas the S&P 500 has returned 11.67% in USD and the TSX has returned 21.11% in CAD. On an unlevered cumulative basis, Logos LP’s units have appreciated 52.88%. Since inception on March 26th 2014 a Logos LP unit holder would have earned an unlevered annualized net return of 19.22% in CAD, outpacing both the S&P 500 and TSX composite indexes during that time span in their respective currencies.

To put this performance in perspective the Barclay Hedge Fund Index which is a measure of the average return of all hedge funds (excepting Funds of Funds) in the Barclay database showed a 2016 YTD performance of 6.18%.

Data from HFI was even worse indicating that the average investor in a hedge fund in 2016 would have seen their money grow a mere 2.5%.

Based on data from Openfolio a network with more than 70,000 members who share their investment portfolios, the average investor had a gain of roughly 5% in 2016.

We had a pretty good year but we believe we can do much better.

Thought of the Week

"There is nothing noble in being superior to your fellow man; true nobility is being superior to your former self.” -Ernest Hemingway

Stories and Ideas of Interest

Is Donald Trump the modern day Mussolini? President-elect Donald Trump’s targeting of corporations, to make them change their practices, is reminiscent of policies in Italy under dictator Benito Mussolini, according to billionaire bond manager Bill Gross. To be honest I am already growing weary of Trump’s disruptive tweets. It isn’t clear to me why the most influential man in the world would bother to tweet about things like the new star of The Apprentice yet threatening publicly traded companies via twitter is concerning. Furthermore, with no known special security protections @realDonaldTrump could be exploited for financial gain, to cause geopolitical instability or worse. It is now in fact the most powerful publication the the world as it has moved markets, conducted shadow foreign policy, and reshaped the focus of media around the world. The irony of Trump’s Twitter interventionism in US business is that Ford’s bow to Trump benefits robots, not workers.

10 charts for tracking whether Trump is delivering on his economic promises. Quartz has provided an at-a-glance dashboard for measuring the economy under president Trump. They have collected 10 indicators that reflect his main campaign promises, with data from the George W. Bush and Barack Obama administrations to provide context. They’ll update the data as Trump puts his plans into action. Things are tense as millennials aren't so optimistic. In fact, this generation is the only one to say they're feeling worse, financially, about 2017 than 2016.

What history says has to say about the economy trump will inherit. Interestingly, research suggests factors beyond the control of any U.S. president, not their actual policies, set the course of the economy. Yet with voters, President-Elect Donald Trump will secure much of the praise or blame when it comes to the impact of his agenda over the next four years.

The Ultimate Authoritative Unimpeachable Top 20 Books of 2016. You could easily read so many best-books-of-the-year rankings that you’ll never get around to reading the actual books. Kira Bindrim has saved you the bother by aggregating dozens of rankings to create a master list.

Bloomberg News reporters in more than 100 cities will cover the stories that matter most in 2017. Here's a selection of key events for the year, plus links to related QuickTake guides. QuickTakes highlight the underpinnings of complicated subjects, providing a concise, fun-to-read entry point to current debates.

The year in technology: 2016 in charts. Bloomberg puts together a nice visual compilation of some of the most significant 2016 events in tech. Also don't miss IBM's annual list of 5 innovations that it thinks will change our lives within 5 years.

Travel in 2017. Today’s fast-changing, hyper-globalized world has no shortage of incredible travel opportunities. This year, Bloomberg has done all the legwork for you in rooting out the best, pinpointing the biggest hotel openings and cultural events of the year—along with the places you’ll want to see now, before they change forever. Looking to retire? CNBC puts together a list of the best spots worldwide to do so.

All the best for a productive year,

Logos LP