Good Morning,

Stocks closed at record highs on Friday to end the first trading week of the year as traders weighed the prospects of new fiscal aid as well as disappointing U.S. jobs data.

Stocks started off the new year with a slump on Monday, but the market churned higher as expectations of more government aid increased with Democrats winning two key Senate races in Georgia, according to NBC News projections.

The U.S. economy lost 140,000 jobs in December, the Labor Department said. Economists polled by Dow Jones expected a gain of 50,000.

The unexpected drop in employment came as the recent surge in COVID-19 cases across the country has forced state and local governments to re-take stricter measures to mitigate the outbreak. More than 21.5 million coronavirus cases have now been confirmed in the U.S., according to data from Johns Hopkins University. The U.S. reported more than 4,000 COVID-19 deaths Thursday -- the most virus-related deaths the country has reported in one day since the pandemic's start.

It's the third day in a row of record daily deaths from the disease, according to data from Johns Hopkins University.

Still markets surged higher the weaker-than-expected employment print raised the possibility of more government aid from the incoming Biden administration.

Our Take

What a year: a global pandemic, continuous shutdowns, unparalleled government and central bank intervention, the fastest 30% drop in market history, the shortest bear market ever, followed by the quickest recovery on record!

Reflecting back on 2020, the qualities of water go far to describe what surprisingly turned out to be a great year for the bullish investor who was able to stay disciplined despite the chaos.

Why did the markets end the year in a resounding crescendo of all-time record highs? The primary reason the rebound was so swift was due to overwhelming government and central bank intervention which allowed most business entities to keep the lights on during even the darkest of COVID-19 days. Many vulnerable “old economy” businesses were never forced to close their doors while COVID-19 made it apparent to investors that “disruptive innovation” based businesses (such as DNA sequencing, robotics, energy storage, artificial intelligence, digitization and blockchain technology) form the backbone of economies all around the globe.

The message from the stock market was clear. It saw and continues to see an economy that is fundamentally changed due to technology and is resilient enough to recover. Both the investor who was positioned in “disruptive innovation” before COVID-19 struck, and the investor who quickly recognized this theme and repositioned their portfolio, did extraordinarily well in 2020.

When it came to our portfolio at Logos LP, coming into 2020, its composition reflected an early recognition of how fundamental the above theme of “disruptive innovation” and technological change was becoming, but in the depths of March as markets plunged “limit down” and lockdowns began to grip the globe, we felt that the global economy had likely entered a period of convulsive changes, some positive and others devastating, that would shape financial markets for years to come.

As such, our portfolio’s composition has shifted to reflect our core belief that revolutionary technological changes are creating not only exponential growth opportunities but also black holes in global economies and financial markets.

Contrary to the popular discourse which pits “growth against value”, we believe that 2020 has shown us a way to synthesize the two seemingly opposite investment approaches.

In modesty, just as in the 1930s and 1940s when Benjamin Graham argued that the old investing framework which was dominated by railway bonds and insider dealing had become obsolete, we believe that the classical “value investing” doctrine can be updated.

Just as Graham provided a much-needed overhaul of investment doctrine, we believe that value investors today can improve their frameworks by incorporating into their analyses the rise of intangible assets and the importance of externalities ie. costs that firms are responsible for but avoid paying.

From 2020 on, it has become apparent that innovation is evolving at such an accelerated pace that traditional equity and fixed-income benchmarks are being populated increasingly by so-called value traps, stocks and bonds that are "cheap" for a reason. As such, we believe that future investment success will require a certain amount of “adapting to the course of the river” in order to find oneself on the right side of disruptive change and innovation.

In John Templeton’s timeless 16 rules for Investment Success (published in 1933) he states:

“The investor who says, ‘This time is different,’ when in fact it’s virtually a repeat of an earlier situation, has uttered among the four most costly words in the annals of investing.”

For those who may suggest that all this talk about “disruptive innovation” amounts to the same old “This time is different” story, it is important to remember a quote by Blogger Jesse Livermore at Philosophical Economics:

“Not only is this time different, every time is different. That’s why so many investors are able to outperform the market looking backwards, using curve-fitted rules and strategies. But when you take them out of their familiar historical data sets, and into the messiness of reality, where conditions change over time, the outperformance evaporates.”

He continues:

“Now, in hearing this suggestion, readers will scoff: “So you’re saying this time is different?” Of course I am. Of course this time is different. By suppressing this conclusion, even when the data is screaming it in our faces, we hinder our ability to adapt and evolve as investors. Reality doesn’t care if “this time is different” will upset people’s assumptions and models for how things are supposed to happen. It will do whatever it wants to do.”

This is the problem with many more “traditional” value investors who for years now have found themselves on the wrong side of disruptive change and innovation. The process of learning and growing as an investor is never over. It is a lifelong pursuit.

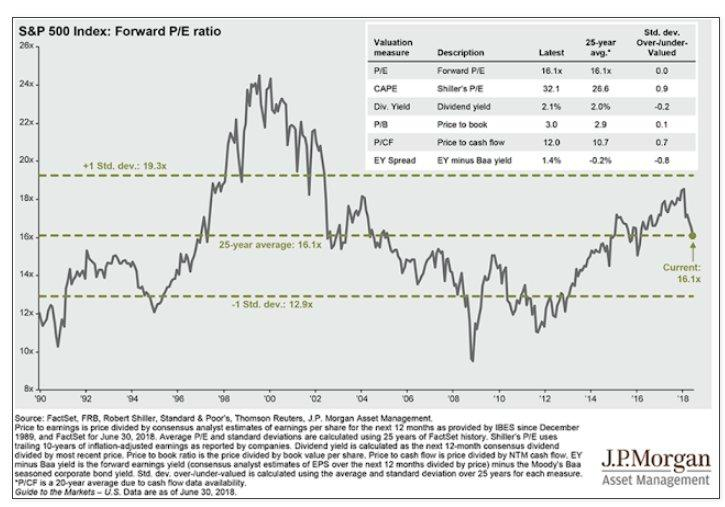

Alternatively, investors that blindly follow valuation metrics based purely on past averages are falling prey to their own psychological issues even though they think they are acting rationally by following their models.

To simply look back historically at a few classic valuation metrics and say prices are below average, so buy or prices are above average so sell is a recipe at best for mediocrity and at worst for disaster.

It’s never that black and white. If investors would have simply followed those easy models, they would have likely sat on the sidelines for the bulk of this market cycle. It’s far too difficult to use one or even a handful of classic indicators to know exactly when a cycle is at a major inflection point and about to change directions because at the end of the day they are driven by irrational human emotions.

Perhaps our biggest investment takeaways from 2020 is that markets will:

1) always be different in terms of their current state and what factors are contributing to the prices of certain securities. We believe that moving forward, avoiding industries and companies in the clutches of "creative destruction" and embracing those creating "disruptive innovation" will prove lucrative; and

2) never be different when it comes to our inherent irrational human emotions and biases: manias and panics won’t be disappearing any time soon.

Musings

Investors ended one of the market’s wildest years on record by piling into everything from bitcoin to emerging markets, raising expectations that a powerful economic comeback will fuel even more gains.

The breadth of this rally is remarkable. It can be thought of as an “everything rally” which has sent most assets to record highs. It was a good year for those who held assets and a painful year for those with few skills, little education and no assets. The result is a financial chasm between the have and the have-nots which is much deeper than what existed prior to the onslaught of COVID-19.

We expect the chasm to widen even further in the coming years as disruptive innovation wreaks havoc on any individual or company not investing aggressively in innovation. In harm's way are companies that have spent the last 10-20 years engineering their financial results to satisfy the short-term demands of short-sighted investors and individuals who are unwilling to update their playbooks and skillsets. We believe the winners will win big and the losers, particularly those that have levered balance sheets (often companies who employ many low skilled workers) to satisfy certain stakeholders, and those who refuse to upskill will be dislocated leading to even greater levels of permanent unemployment.

Nevertheless, we believe there is reason for optimism.

1) The economy and markets have a history of finding a way through unprecedented challenges. It is important to reflect on the historical ability of humankind to adapt and innovate in the face of hurdles, even those that seemed insurmountable. We created a vaccine in record time, avoided what could have been an economic depression and will continue to push on in 2021.

2) There are still compelling reasons to invest in 2021. There's still much work to be done, but the U.S. and global economies are on a trajectory of recovery, which provides a favorable environment for risk assets. On the whole, U.S. economic data is still coming in better than expected, even if momentum has slowed. Manufacturing activity, initial unemployment claims and consumer activity have all rebounded impressively off lows. The Federal Reserve is unlikely to deviate from its accommodative course especially with so many still unemployed. Economies are getting massive liquidity injections, cash in circulation is soaring and annual growth of U.S. cash in circulation typically peaks at the start of economic cycles. The world is positioned for synchronized global growth and companies are positioned for impressive earnings growth. Inflation may ramp up a bit, but we think that the probability that it will upend markets in any meaningful way is low as policy makers and central banks are well aware of the disastrous consequences of any sudden rise in inflation (asset prices at all time highs supporting the “wealth effect” underpinning the recovery, a plethora of overleveraged zombie firms and perhaps most importantly most states’ vastly expanded balance sheets-both governments’ debt and central banks’ liabilities).

3) A business-friendly approach to taxes and regulation has been a key driver of markets over recent years and there is little reason to believe this will change as there is little appetite to derail the fragile recovery and instead, there is appetite for major infrastructure spending. With neither political party having a significant majority in the Senate, this will likely mitigate the scale of fiscal policy shifts.

The real question is how much of the above 3 factors have investors already priced into markets? To what extent have investors pulled forward future returns to the present?

We are certainly flying high yet that doesn’t mean that stocks can’t push higher still. When studying the history of stock market excesses, particularly the excess of the 1999/2000 era what is apparent is that calling the market overextended or spotting a bubble is easy as investors were comparing the internet sector to tulip mania as early as mid-98. What is much more difficult is the ability to time a profitable exit...

As Epictetus in Discourses, 2.5.4-5 reminds us:

“The chief task in life is simply this: to identify and separate matters so that I can say clearly to myself which are externals not under my control, and which have to do with the choices I actually control. Where then do I look for good and evil? Not to uncontrollable externals, but within myself to the choices that are my own…”

2020 so starkly reminded us of the virtues of humility. To be humble in our predictions and forecasts. Humble as to what we believe we can control. Humble as to our talents and abilities. Open to an attitude of “Amor fati” which may be translated as "love of fate" or "love of one's fate".

Willing to embrace an attitude in which one sees everything that happens in one's life, including suffering and loss, as good or, at the very least, necessary.

Charts of the Month

Financial conditions are also the most loose on record.

While many stocks have delivered other worldly performance.

As mania spread to derivatives.

Amazing comeback story.

Last year 54% of all new cars sold in Norway were battery-powered electric vehicles, making Norway the first country in the world where electric vehicles (EVs) outsell traditional petrol, diesel or hybrid vehicles. With new models from Tesla, BMW, Ford & Volkswagen all due to hit the market next year, Norway seems very much on track to meet their target of ending the sale of diesel and petrol cars by 2025. Perhaps the world is next?

Logos LP December 2020 Performance

December 2020 Return: 5.48%

2020 YTD (December) Return: 99.71%

Trailing Twelve Month Return: 99.71%

Compound Annual Growth Rate (CAGR) since inception March 26, 2014: +25.43%

Thought of the Month

"Join with those who are as flexible as the wood of your bow and who understand the signs along the way. They are people who do not hesitate to change direction when they encounter some insuperable barrier, or when they see a better opportunity. They have the qualities of water: flowing around rocks, adapting to the course of the river, sometimes forming into a lake until the hollow fills to overflowing, and they can continue on their way, because water never forgets that the sea is its destiny and that sooner or later it must be reached.” — Paulo Coelho “The Archer”

Articles and Ideas of Interest

The pro-Trump mob was doing it for the gram. But it was also quickly apparent that this was a very dumb coup. A coup with no plot, no end to achieve, no plan but to pose. Thousands invaded the highest centers of power, and the first thing they did was take selfies and videos. They were making content as spoils to take back to the digital empires where they dwell, where that content is currency.

What Warren Buffett’s losing battle against the S&P 500 says about this market. In 2020, Berkshire Hathaway shares were up, but not by much (2%), against an S&P 500 that gained over 18%, with dividends reinvested, according to S&P Global. Taken together, the two-year stretch of 2019 and 2020 marked one of the biggest gaps between Berkshire and the broader U.S. stock market in recent history, with the Buffett trailing the index return by a combined 37%. What does it mean?

Does Joe Biden have too much power as he will undoubtedly face pressure from extremist left to use it? Joe Biden has a problem on his hands, other than the man in the White House who refuses to behave himself or go away. Kelly McParland digs in. How concerned should investors be about Biden’s tax proposals? After the Democratic sweep of both Georgia senate seats this week, Goldman Sachs now expects the Fed to raise interest rates in 2024 instead of 2025.

A majority of investors believe the stock market is in a bubble - and many fear a recession, according to an E*Trade survey. A new E*Trade Financial survey of 904 active investors revealed that 66% of them believe the stock market is either fully or somewhat in a bubble. An additional 26% said the stock market is "approaching a market bubble." The survey also revealed that recession fears linger. 32% of investors listed a recession as their top portfolio risk right now. But they remain fully invested with inflows surging and the consensus long…

Canadian expert's research finds lockdown harms are 10 times greater than benefits. Finally an honest analysis of ROI from an early proponent of lockdowns. Emerging data has shown a staggering amount of so-called ‘collateral damage’ due to the lockdowns. This can be predicted to adversely affect many millions of people globally with food insecurity [82-132 million more people], severe poverty [70 million more people], maternal and under age-5 mortality from interrupted healthcare [1.7 million more people], infectious diseases deaths from interrupted services [millions of people with Tuberculosis, Malaria, and HIV], school closures for children [affecting children’s future earning potential and lifespan], interrupted vaccination campaigns for millions of children, and intimate partner violence for millions of women. In high-income countries adverse effects also occur from delayed and interrupted healthcare, unemployment, loneliness, deteriorating mental health, increased opioid crisis deaths, and more.

After embracing remote work in 2020, companies face conflicts making it permanent. Although the pandemic forced employees around the world to adopt makeshift remote work setups, a growing proportion of the workforce already spent at least part of their week working from home, while some businesses had embraced a “work-from-anywhere” philosophy from their inception. But much as virtual events rapidly gained traction in 2020, the pandemic accelerated a location-agnostic mindset across the corporate world, with tech behemoths like Facebook and Twitter announcing permanent remote working plans. Not everyone was happy about this work-culture shift though, and Netflix cofounder and co-CEO Reed Hastings has emerged as one of the most vocal opponents. “I don’t see any positives,” he said in an interview with the Wall Street Journal. “Not being able to get together in person, particularly internationally, is a pure negative.” Very interesting expose in Venture Beat.

The Life in The Simpsons Is No Longer Attainable. The most famous dysfunctional family of 1990s television enjoyed, by today’s standards, an almost dreamily secure existence that now seems out of reach for all too many Americans. I refer, of course, to the Simpsons. Homer, a high-school graduate whose union job at the nuclear-power plant required little technical skill, supported a family of five. A home, a car, food, regular doctor’s appointments, and enough left over for plenty of beer at the local bar were all attainable on a single working-class salary. Bart might have had to find $1,000 for the family to go to England, but he didn’t have to worry that his parents would lose their home.

mRNA vaccines could vanquish Covid today, cancer tomorrow. The incredible progress made in developing the Covid vaccines should not be understated as we may be on the edge of a scientific revolution in human health. It looks increasingly plausible that the same weapons we’ll use to defeat Covid-19 can also vanquish even grimmer reapers — including cancer, which kills almost 10 million people a year.

Our best wishes for a year filled with joy and contentment,

Logos LP