Good Morning,

Stocks fell on Friday, with the Dow Jones Industrial Average posting its worst weekly loss since October, as investors began to question the reflation trade narrative of above trend growth and higher inflation.

Pockets of the market most sensitive to the economic rebound led the sell-off this week. The S&P 500 energy sector and industrials dropped 5.2% and 3.8%, respectively, for the week. Financials and materials meanwhile, lost more than 6% each. These groups had been market leaders this year on the back of the economic reopening.

Volatility broke out in equities following Wednesday’s Fed decision, where policy makers projected raising interest rates twice by the end of 2023. The tech rally was accompanied by a violent flattening of the 5-year to 30-year Treasury yield curve, which narrowed by the most since 2011 on a weekly basis.

Our Take

We have been largely uninspired by the endless popular coverage of the following three themes: meme stocks, cryptocurrency (scamcoins) and inflation. Without repeating the tired warnings about the risk surrounding investment in such above mentioned speculative assets, (Michael Burry has done an excellent albeit dramatic job of this) we do believe that the topic of inflation warrants a few thoughts as a follow on to our assertion back in March of this year that the rise in inflation and interest rates would be a temporary diversion from a clear downward trend.

The robust economic recovery we have witnessed has understandably come with some inflation as the pent-up demand has simply overwhelmed supply. Yet we remain of the opinion that there is enough evidence mounting to suggest the Federal Reserve is correct in its prediction that the inflation scare will be transitory. In fact, the reflation trade may have peaked around June 10. The CPI reading came in at 5% year-over-year, ahead of estimates for 4.7%. But despite the hotter than expected reading, bond yields continued to slide. Despite months of hotter than expected inflationary data points, bond yields have been moving lower, and breakeven inflation expectations are now sliding as well.

It seems likely that inflation rates have now peaked, and we should begin to see easing inflation levels in the coming months as commodity prices such as copper, soybeans, lumber, and gasoline have either flattened or have started to decline.

It's clear now that the yields are looking into the future, not the past. The Federal Reserve appears to have recognized that it might have to raise rates - earlier than expected - to deal with a possible inflationary threat. Market participants could be realizing that tightening from the Fed could temper GDP growth (China’s growth is already moderating and the ECB sees lower inflation forecasts starting in 2022). This concern was recently expressed by Goldman Sachs: "Investors may be interpreting the Fed's hawkish tilt Wednesday as a sign that an extended U.S. post-pandemic economic expansion may be a bit harder to achieve in a potentially emerging environment of less accommodative monetary policy.” Interestingly, since Wednesday’s Federal Reserve meeting, there has been a drastic flattening of the so-called Treasury yield curve. This means the yields of shorter-duration Treasurys — like the 2-year note — rose while longer-duration yields like the benchmark 10-year declined. The retreat in long-dated bond yields reflects less optimism toward economic growth, while the jump in short-end yields shows the expectations of the Fed raising rates. Yields on junk bonds also fell below inflation (see chart below).

But the most significant issue isn't interest rates, it is inflation expectations, and they have been falling sharply (The Cleveland Fed says five-year inflation expectations are still just 1.5% a year and how hawkish can the Federal Reserve’s recent commentary really be if, all told, the most skeptical members are thinking about raising rates by 0.5% in 2023?). This is sending a negative signal to the reflationary parts of the equity market, the parts of the market that were riding the wave of prospective yield and inflation increases. Lock in step, the rate of change for commodities is stalling out, and if so, the Federal Reserve's call for transitory inflation will likely be correct. That could mean we have witnessed peak inflation for this cycle and that the probability of inflation surprising to the upside is on the decline.

And this all makes sense. Financial markets’ sensitivity to monetary policy has NEVER been higher. The Federal Reserve’s balance sheet has doubled since the end of the 2008 financial crisis, now 40% of gross domestic product. By buying massive amounts of bonds, the Fed has lowered rates and used asset prices—especially stocks and real estate—as a primary tool for monetary policy. That’s through the wealth effect, or the tendency for consumers (which make up two-thirds of gross domestic product) to spend more as their assets grow. Any meaningful correction in stock or real estate prices would hamper economic growth and thus limit the Fed’s ability to tighten.

Furthermore, when one considers the debt side of the economy, Lisa Beilfuss for Barron's reminds us that if the Federal Reserve was unable to lift rates above 2.5% during the last tightening cycle, and had to cut rates in SEVERAL meetings BEFORE its unprecedented actions during the pandemic, why would it be able to raise now?

Since the pandemic began, U.S. households, businesses, and the federal government have grown only more indebted (which is the case all over the West including Canada). When most of the developed world is running on debt-driven growth it’s very hard to raise rates. Furthermore, it requires increasing levels of debt to generate lower rates of economic growth. At present in America, the economy requires roughly $5.01 of debt to create $1 of growth. While already a poor return on investment, it will worsen as debt continues to retard economic growth.

Since 1980, the overall increase in debt has surged to levels that currently undermine almost the entirety of economic growth. With economic growth rates now at the lowest levels on record, the change in debt continues to divert more tax dollars away from productive investments into the service of debt and social welfare.

As the market begins to price in the above, the problem for its indexes such as the Dow, S&P and Russel, is that if inflation expectations continue to fall, the reflation trade which has been driving their outperformance, will likely fall with them as cyclicality is repriced.

On our end, we have remained on the sidelines when it comes to the reflation trade and are instead positioned primarily in sustainable growth at reasonable valuations. Looking forward, we believe the path of least resistance is a return to the pre-Covid investment environment characterized by structural deflation, below trend growth and perhaps even stagnation as policymakers in the West shift their focus from growing the pie to splitting the pie.

Musings

Of late we have been focusing our attention on the evaluation of under followed smaller capitalization stocks set to benefit from certain structural changes in their respective industries.

We believe Biodesix (BDSX) offers an interesting risk/reward.

Biodesix is a data-driven diagnostics company that has developed a proprietary AI platform called the Diagnostic Cortex to discover innovative diagnostic tests for clinical use, with particular focus on the lung. The particular problem that their platform solves is what researchers call ‘overfitting’: this is when machine learning-based biological discoveries cannot be repeated or assessed in additional specimen cohorts (ie. the machine can identify something in a genomic dataset but not in a proteomics dataset).

We recently had a call with management and believe the company is hitting an interesting inflection point over the medium term as the company is facing a few key catalysts into 2022:

1. Re-ignited volumes: As pulmonologists and clinics open up, this will reignite lung based diagnostic testing volumes away from Covid tests.

2. Salesforce expansion: The company raised $64 million in its IPO on Oct. 2020 which will be used to double the salesforce by the end of the year. Travel restrictions and delayed ramp up were all headwinds in the beginning of the year but that should subside in the back half.

3. Biopharm services: The reopening of clinics and non-Covid testing means the reopening of clinical trials at biopharmaceutical companies. The biopharm segment is a higher margin segment than their diagnostic business.

4. New innovative tests: The more data collected from patients and biopharm companies means more data into their AI platform which means more tests. The company has launched multiple new tests since the beginning of the year and launched a Covid test in record time late last year. This also means they will be able to collect new data and create partnerships with other providers (ie. Datavant).

5. Competition: Most of their tests have no real competition from other diagnostic companies.

On the back of a near 60% drawdown a few weeks ago, the company traded at a little under 7.9x next year's revenues (Guardant Health, which is somewhat of a comparable, trades at a much higher valuation) and should see meaningful revenue growth in the coming years. Their unique platform flywheel coupled with their agility when launching new tests and upcoming catalysts should lead to a much higher valuation as the company progresses up its S-curve growth runway.

Charts of the Month

Money just keeps getting cheaper…

The Citi Economic Surprise Index—which measures how economic data is coming in relative to expectations—has come significantly off the boil relative to its peak last July. The accompanying table shows that as the index descended historically, so did annualized returns for the S&P 500.

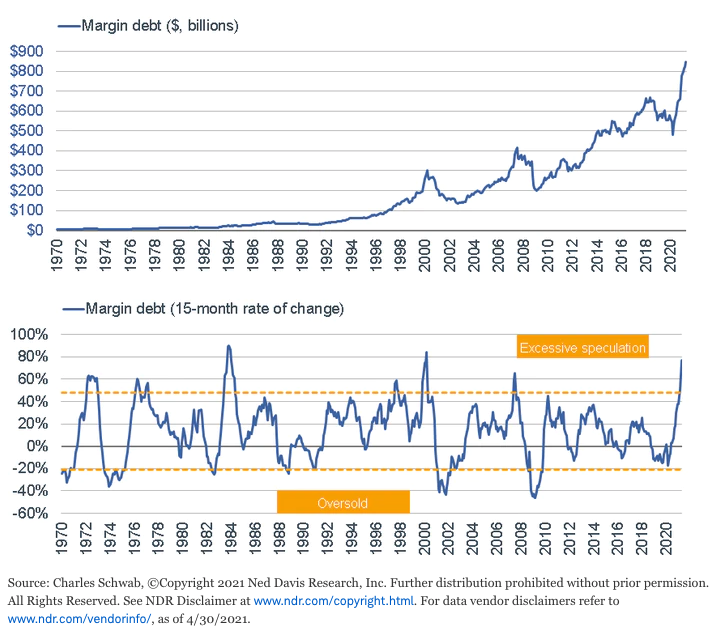

Ned Davis Research has looked at those points in time when margin debt hit a peak and then began descending—considering them “sell signals.” Following those signals, the average subsequent returns for the S&P 500 for time periods ranging from three-to-18 months since 1970 were all in negative territory—although not to a significant degree.

As measured by The Conference Board, CEO confidence is at a record high as you can see in the chart above. Historically, this has worked as a contrary indicator as it possibly signals the environment is “as good as it gets,” which you can see in the accompanying table.

Logos LP May 2021 Performance

May 2021 Return: -6.28%

2021 YTD (May) Return: -3.46%

Trailing Twelve Month Return: 49.09%

Compound Annual Growth Rate (CAGR) since inception March 26, 2014: 23.21%

Thought of the Month

“Just imagine traveling 10 years back in time and trying to explain this to someone; just imagine what an idiot you’d feel like. “There’s going to be this online currency that people think is a form of digital gold, and then there’s going to be a different online currency that is a parody of the first one based on a meme about a talking Shiba Inu, and that one will have a market capitalization bigger than 80% of the companies in the S&P 500, and its value will fluctuate based on things like who is hosting ‘Saturday Night Live’ and whether people tweet a hashtag about it on the pot-joke holiday, and Bloomberg will write articles and banks will write research notes about those sorts of catalysts, and it will remain a perfectly ridiculous content-free parody even as people properly take it completely seriously because there are billions of dollars at stake.” - Matt Levine

Logos LP Services

Looking for proprietary research? We would be happy to chat. Please book an intro call here.

Articles and Ideas of Interest

Boredom: An Investor’s last remaining edge? The entire investment world thrives on activity and commotion. Zero-commission trading turns investing into a sport. Ill-chosen LPs want decisions to justify management fees. Brandon Beylo for Macro-Ops suggests that the best investors are the ones that have an unnatural ability to choose inactivity. As crazy as it sounds, boredom is an investor’s last remaining competitive advantage.

Millennials are running out of time to build wealth. The oldest members of the generation turn 40 this year. They’re only 80% as wealthy as their parents were at this age. Should we be surprised that 51% of young Americans say they feel down, depressed or hopeless?

What a work-from-home revolution means for commercial property. As offices remain empty, does a financial reckoning loom? The Economist suggests that the fate of office property could well rest on vacancy rates. If they stay high, then things could start to get hairy. In April the imf reckoned that a lasting increase in the vacancy rate of five percentage points would dent commercial-property valuations by 15% over five years. Fitch, another rating agency, estimates that the value of offices in America could fall by more than half if workers continue to work from home for three days a week. The long-term nature of property leases and the continued availability of debt mean that losses from the pandemic may not materialise for several years. But if the reckoning comes, it will be painful.

Has there ever been a worse time to be a homebuyer? Yes, rates remain low and houses are bigger and better than ever but this is likely the worst buyer’s market in modern economic history. Ben Carlson digs in and suggests that on a relative basis, it’s probably never been cheaper to rent in most areas.

Scamcoins and other hyped stocks on social media are still all the rage. Is this time different? Jamie Catherwood puts together a fantastic historical overview of times of fraud, mania and chicanery suggesting that the reckless speculator is alive and healthy. Of particular note is his inclusion of the story of Gregor MacGregor who pulled of the greatest confidence trick of all time. MacGregor found an uninhabited piece of land on the coast of Honduras, created a fictitious country called Poyais, and sold over a billion dollars worth of ‘Poyais bonds’ in London by misleading investors into thinking the uninhabited jungle he had found in Honduras was actually a legitimate country boasting beautiful architecture, an opera house, parliamentary building, cathedral, and more. Eventually, seven ships in total came to Poyais with passengers looking to settle in MacGregor’s fairy tale paradise. Of the 240 settlers that arrived, only 60 survived. How many investors will survive today’s manias?

When companies replace people with machines, the government loses the ability to tax workers resulting in millions of dollars worth of lost tax revenues a year. McDonalds, Dominoes and other quick service restaurants are actively replacing human workers with robots. Can taxing robots as if they are human employees be the solution? What are the pros and cons of a robot tax?

Cal Newport on why we'll look back at our smartphones like cigarettes. Cal for GQ suggests how we're always ceding our autonomy to these devices as well as some of the long-term ramifications of always craving that constant hit of stimuli and distraction. No wonder studies have shown that social media makes us feel terrible about who we really are. Neuroscience explains why – and empowers us to fight back. No wonder quitting has become the ultimate form of self-care.

A (small) pre-emptive strike against the doomsday asteroid. In March 1989, an asteroid measuring half a mile wide careened past Earth at 46,000 miles per hour. When it crossed Earth’s orbit, it was only 425,000 miles away—about twice the distance between Earth and the moon and an uncomfortably close shave for an object the size of a football field. If the asteroid had slammed into the planet, it would have punched a hole in Earth’s crust with the force of 20,000 hydrogen bombs, excavating a crater between five miles and 10 miles wide and a mile deep. Anything within a 40-mile radius would have been obliterated, and dust flowing into Earth’s atmosphere would have cooled regional temperatures enough to affect crop growth, causing localized food shortages. If it had slammed into the ocean instead, millions of people worldwide could have been killed by the ensuing tsunamis. With the DART mission, scientists have attempted to prepare for Earth’s worst catastrophe. The thought of such an asteroid is fascinating. Most of us spend our lives avoiding the thought of death yet its inevitability should be continually on our minds. Understanding the shortness of life and its precarity should fill us with a sense of purpose and urgency to realize our goals.

Scientists have determined the oldest age humans can live to and it depends on our relationship to stress. Researchers studying the relationship between aging and the ability to cope with stress found that the limits of a human lifespan lie anywhere from 120 to 150. Based on data collected from an iPhone app and medical records from volunteers in both the United States and United Kingdom, the study’s authors measured subjects’ resilience to stressors. With age, the researchers found a decline in the subjects ability to recover. “As we age, more and more time is required to recover after a perturbation, and on average we spend less and less time close to the optimal physiological state,” study author Timothy V. Pyrkov said in a press release.

Canada is on the wrong path when it comes to residential real estate and long-term prosperity. The country is now 50% more dependent on housing than the US bubble in 2006. Furthermore, Canadians are spending so much on housing that they have limited ability to spend elsewhere. According to a recent report from National Bank of Canada, the typical homebuyer in Toronto spends 56 per cent of their income on mortgage payments. In Vancouver, it’s 64 per cent; in Hamilton, it’s 34 per cent; and in Victoria, it’s 58 per cent. During the pandemic, real estate prices increased rapidly in small towns and rural communities, meaning even more Canadians are struggling with housing affordability. Many Canadians are aware of how our sky-high real estate prices negatively affect young people and exacerbate income inequality. Less frequently discussed, however, is that larger mortgage debts result in fewer people pursuing entrepreneurship. A study from the Bank of England found that “mortgage debt diminishes the likelihood of entrepreneurship by amplifying risk aversion,” and that this “may hinder economic activities and adversely affect the general economy.” Also, according to the Brookfield Institute for Innovation + Entrepreneurship, 42 per cent of the Canadian labour force is at high risk of having their jobs automated over the next 10 to 20 years. In light of these trends, Scott Stirrett suggests that it is increasingly essential to foster entrepreneurship to build high-growth firms that create new jobs so that all Canadians have the opportunity to find meaningful employment and meet their basic needs.

Our best wishes for a month filled with joy and contentment,

Logos LP