2015 began with one of the worst months for the stock market with the Dow Jones Index falling 3.7% while the S&P 500 Index suffered a decline of around 3%. This poor performance was linked to several dark clouds hanging over investors. The main themes are:

1) Global GDP growth is faltering

In January the IMF cut its forecast for global growth by 0.3 percentage points to 3.5% this year and 3.7% next year. Japan has slipped back into recession, Europe is on the brink of recession, the developing world is facing commodity linked headwinds, Russia’s economy is in shambles and China is experiencing its slowest growth in a quarter century. Some point to the United States as a bright spot in the world economy citing its strong GDP growth relative to other countries yet it should be remembered that Q4 GDP missed expectations dragged down by slowing business investment.

2) Loss of confidence in central banks

Central banks all over the world have brought interest rates down to ultra low levels and have embarked on massive monetary stimulus programs. Yet these unprecedented measures, meant to be short-term solutions to fight a collapse in the financial system and a descent into deflation, have remained in place far longer than central banks had envisioned. Instead, these programs have not caused any meaningful increase in the flow of money that was meant to ignite spending and investment. Inflation has not picked up and amazingly central banks everywhere are stepping up their efforts by further slashing rates and increasing bond buying programs.

3) Global trade is in decline

We live in a highly interconnected world and cross border trade remains a key GDP growth driver. According to the International Monetary Fund, between 1996 to 2007 world trade volumes grew by an average of 7 percent a year but since, 2010 volumes have only grown by 4 percent.

4) Global debt is still at a record high

It would appear that we have not seen the last of excessive debt wreaking havoc on the financial sector. According to last fall’s Geneva Report, commissioned by the International Centre for Monetary and Banking Studies interest rates across the world will have to stay low for a “very, very long” time to enable households, companies and governments to service their debts and avoid another crash. The report finds that total world debt (government, corporate and household) is at a record 212 percent of gross domestic product as of the end of 2013, up from 174 per cent in 2008. Furthermore, some countries like the U.S and the UK have swapped private sector debt for public sector debt and in other countries like Canada and emerging markets, household debt has reached unprecedented levels.

5) The employment situation looks weak

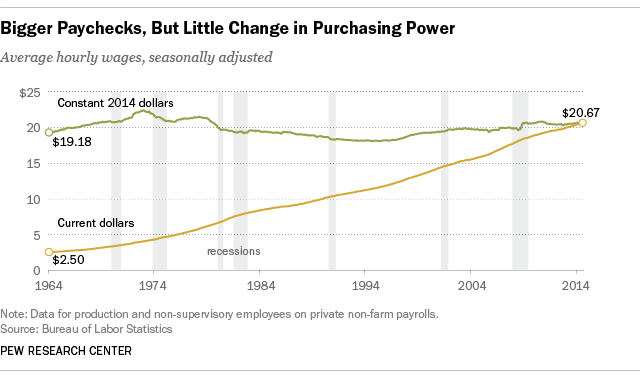

Productivity has been poor, labor force participation rates are low and most alarmingly, wages have not been growing. In fact, for most US workers, real wages have barely budged for decades.

This appears strange in light of strong year over year growth in corporate profits yet labor market slack appears to be the main culprit. The current overcapacity of workers has meant that there is little need for hiring. With automation permeating modern businesses there has been a broad decline in both high and low paying jobs. This has lead to further overcapacity and has reduced the incentives for employers to raise wages reinforcing the cycle of weak consumption and slow growth.

6) US Q4 corporate earnings reports point to a slowdown in 2015

Around 80% of reporting S&P 500 companies have beaten estimates on earnings and 58% on sales which marks the 8th consecutive quarter of year-over-year earnings growth for the index after a year over year decline in Q3 2012 (-1.0%). Nevertheless, this earnings growth is not projected to continue into 2015 as Wall Street has revised estimates down from a 4% increase to an overall earnings growth of around -2%.

7) The price of oil has taken a bone chilling dive

The price of oil has dropped to 6 year lows in only 6 months sparking a fierce debate over whether lower prices are on balance a positive for global growth. Is this drop in oil prices simply an oversupply issue or is it a symptom of something more sinister such as a slowdown in demand caused by a sputtering global economy?

8) Bond markets have been rallying

Around the world investors have been opting to buy bonds with negative yields which on paper imply a guaranteed loss. Why would investors buy such bonds of various maturities in as many as ten countries?

There could be several reasons but fear is the most significant. By accepting a negative yield investors are signaling their uncertainty about global growth and their appetite for safety.

The apparent question is whether the direction of the market in January will determine the coming year’s trajectory. There is no doubt that the dark clouds explained above have made investors nervous about committing new money to the market yet, as I write, a 7% surge in the price of oil is pushing all major US Indexes higher with key commentators calling a bottom. Can January already be safely forgotten? In my view, slight pullbacks like the one experienced in January are symptoms of a healthy bull market and not yet indicative of an impending prolonged downturn.

Nevertheless, we can worry and debate all we want about whether oil has found a bottom or whether the S&P 500 will end positive for the year but the bottom line is that we shouldn’t lose our focus on the long term. The themes above are important yet what the market does from day to day or year to year shouldn’t be your primary concern. Instead, the wise investor should focus on investing in quality businesses and stay calm in order to take advantage of healthy pullbacks like the one that began 2015.

Originally posted on: Seeking Alpha